Last night Treasurer Jim Chalmers delivered the 2023-24 Federal Budget – the first full budget for this government. Remember that budget they released in October 2022 after winning the election? It’s interesting to look back and compare our assessments of the two. Being so close together, a lot of the circumstances remain the same: cost of living crisis, insane property prices, ongoing global instability, a still-cooking planet… This budget plan tries to hedge its bets, doing the smallest amount possible in a lot of areas but nothing substantial enough to address any one issue meaningfully.

Politically, it makes sense: the Labor party had an opportunity to disprove the myth that the Liberal party is “better at managing the economy”, especially by delivering a surplus. There is literally no criticism the Liberals can give to this budget that would make any sense based on their own values.

In that sense, it’s a political win, even if the message to the public is pretty serious: there are probably two economically very difficult years to go folks! Hang in there.

Here’s our breakdown of the areas most important to you – if you have questions, send them to us hey@zeefeed.com.au

| Surplus | Welfare & Cost of Living |

| Housing & Rent | Climate & Environment |

| Health & Mental Health | Education |

| Wages & Tax | Indigenous Affairs |

First, on the Surplus:

You’ve seen this line a lot – this is the first time Australia’s had a surplus (i.e.: spent less than we made, i.e.: in the black) since 2008. The surplus is $4 billion. Is this big? No, it is a tiny 0.2% of GDP. By comparison, the 2008 budget surplus was $21.7bn or 1.8% of GDP. It is also expected to be a one-off surplus, with the budget forecasts showing we’ll head right back to deficits over the next few years.

There are three main reasons Labor achieved a surplus:

- High company profits, which means more company tax going to the government. In particular, global demand for Australian iron ore and gas have been very high (things that Russia and Ukraine aren’t able to supply at the moment). But this applies to the many big companies that are posting record profits recently – like the big banks

- Very low unemployment in Australia – with more people in work, more income tax can go to the government. Also, while wages growth is not great, it has been better than expected which also translates to slightly higher taxes coming from those wages

- Labor also redirected and cancelled some funding that the previous Coalition government had committed to, keeping the difference rather than spending it

All in all, the government is unlikely to make a very big deal of this but it’s still important you understand the context.

Welfare & Cost of Living:

What’s been promised? The government really, really wants us to focus on their preferred headline: “$14 billion cost-of-living relief!” But the breakdown of what amounts are being spent where are less impressive sounding. There are a lot of individual items that fall under this category, but the big ones are:

- $3bn in electricity bill relief – up to $500 will be taken off the bill for households receiving welfare payments and some small businesses

- $4.9bn increase to JobSeeker, Youth Allowance, Austudy, Abstudy and other welfare payments – an extra $40 per fortnight

- Putting JobSeeker recipients aged 55 and over on the higher rate that was previously reserved for those 60+ (an extra $92 per fortnight for 55-59s)

- Almost $200m in funding for place-based programs, projects and partnerships to tackled “entrenched disadvantage”

What does this mean? This is just a gesture – none of these measures are enough to really help those who are suffering the most in the cost-of-living crisis. The increase to welfare payments works out to $2.85 a day, and leaves them all below the poverty line. Should a country like Australia – seeing a financial benefit from international conflict, high employment and big corporate profits – be leaving its own people in poverty? We firmly believe not.

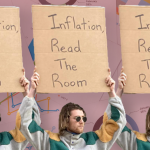

A lot of commentators and some economists insist that any increases to welfare will make inflation worse, but this won’t happen. First, because the amounts being given are just too small. Second, because the government has done a good job of focusing on those who really need it – the most vulnerable. This money is (barely) going to help them afford the essentials required to survive, and won’t end up as discretionary spending in the categories that are driving up inflation the most (holiday travel, property prices). Read this Twitter thread by economist Greg Jericho if you want to understand why.

me, dying of hunger: thank you for the surplus

— Patrick Lenton (@PatrickLenton) May 9, 2023

Housing & Rent:

What’s been promised? Some, but again – not really enough. Most notably we’re getting:

- $2.7bn (over five years) for Rent Assistance – a 15% increase, or an extra $31 a fortnight

- Lifting the cap on loans through the National Housing Finance and Investment Corporation’s (NHFIC) to build affordable and social housing

- Tax breaks for “build-to-rent” projects

What does this mean? It’s an attempt to drive down housing prices (and therefore, rent) by increasing the supply of housing. As a plan, these measures alone will not work. Not only is the rent assistance increase way too small, there has been a lot of discussion about how inadequate the Rent Assistance program is. Property and rental prices are so wildly out of control, that those receiving Rent Assistance are far from the only individuals experiencing housing stress. And while the incentives to build social or affordable housing are just fine, they won’t have the desired result fast enough.

There are more ambitious ideas that could transform the housing market for the better – rent caps, for a start – that this budget simply does not entertain.

Climate & Environment:

What’s been promised? Most of the bigger climate budget items were announced in the 2022 Budget (see: the $15bn reconstruction fund). This time around, the climate focus was on $2bn in funding for the Hydrogen Headstart program, which will support large-scale renewable hydrogen projects; and over $1bn in funding for various loans and programs to make existing homes more energy efficient.

Also, there is $83 million over four years to fund the new National Net Zero Authority (NNZA), an agency to advise on transitioning workers, businesses and new ventures to Australia’s net-zero reality.

Most controversial is the Petroleum Resource Rent Tax (PRRT). This is supposed to be a 40% tax on profits from the sale of resources (oil, minerals, gas) – essentially, because these companies are profiting from a product they did not make, they simply extracted it from Australian land. Up until now, mining and resource companies have been able to avoid paying much PRRT by using an overly generous system of credits and offsets. This budget takes into account new changes to PRRT (explained by Rod Sims here), which will raise $2.4bn over the next five years… which is, embarrassingly, less than what will be raised by the increase tobacco tax ($3bn). Smokers paying more than mining and resource companies, sounds about right.

What does this mean? Overall, it’s honestly not too bad. But – say it with us again! – it could. be. more. This budget takes the same approach that Labor is taking to other environmental and climate legislation, by taking some necessary, but modest, forwards while refusing to commit to the big, basic changes that will make all the difference.

Health & Mental Health:

What’s been promised? Health was a brighter spot in the budget, funding things that will make a more meaningful difference.

- $3.5bn over five years to triple the money that a GP gets when they bulk bill you, to encourage more bulk billing. This will apply to bulk billed appointments for children under 16, concession card holders and pensioners

- $358m for an additional eight Medicare urgent care clinics, to take pressure off hospitals and GPs

- $445m for GP clinics to employ allied health professionals, providing more health services in one location

- $219.4m for the public dental service (accessible to people on low incomes)

Surprisingly, it’s very light on mental health funding – some funds are going into training and education for mental health professionals, like psychologists, to reduce the long appointment wait times, as well as mental health education for other healthcare workers (like nurses). But this effect won’t be immediate, and overall all the funding numbers aren’t huge.

What does this mean? Doctors have been calling for Medicare updates and reform for a long time, and this looks like it could be the beginning of that process. Reducing costs of healthcare for those on low incomes helps to address the cost of living pressures for them too, so these policies make the most sense out of the budget so far.

Education:

What’s been promised? This was the biggest shock – the education sector, specifically universities, was basically ignored in this budget. There will be 4000 funded university positions for courses that relate to those nuclear submarines (not joking!), and $300m will fund 300,000 fee-free TAFE positions from 2024.

But everything else is status quo.

What does this mean? To be fair to the government, there are several education reviews currently in progress – for early childhood, schools and higher education. We’re assuming they’re holding out for these results and recommendations before announcing any major, new plans in the education sector. Fingers crossed for next year, then.

Wages & Tax:

What’s been promised? It’s suspiciously quiet in this area… Notably, this budget did not say anything about the Stage 3 tax cuts, which are due to come into effect in the next 2024/25 budget.

Aged care workers will get a 15% pay rise, costing $11.3bn over the next four years, as recommended by the Fair Work Commission.

An interesting tidbit you might not have seen elsewhere: the government are introducing a minimum tax rate for global multinational corporations from January 2024, to ensure they pay at least 15% income tax in this country. It’s expected to raise $370m over five years.

What does this mean? Let’s be very clear: Australia is in need of serious tax reform. Lots of MPs are ready, eager and calling on the government to start the reform process… but it will be a big beast. Expect to hear more about this, including specific plans, in the next 12 months.

The conversation about the Stage 3 tax cuts (a good general explainer here) will get louder until the next budget too and we are quietly optimistic that the Labor government will scrap them. They don’t make sense for the current reality we’re facing.

Indigenous Affairs:

What’s been promised? National Indigenous Times has a solid breakdown on what is in the budget for Indigenous Australians – read it here. In summary, there is almost $2bn in funding for various initiatives to improve health, housing, education and employment initiatives, and of course money for the delivery of the Voice to Parliament referendum. A significant amount of this money is going to Central Australia and the Northern Territory.

And on top of the existing funding arrangements for First Nations mental health, an extra $10.5m will go to mental health services to support people during the referendum campaign specifically. The absolute least the government could do to address the increased racial vilification, hate speech and harassment Aboriginal and Torres Strait Islander people are already being subjected to in the name of referendum ‘debate’.

Comments are closed.