If you browse the finance section of your local bookstore, library or favourite online retailer, the imbalance is obvious: books about money are overwhelmingly written by men. It creates a gendered divide in who mostly learns about, and gets confident with, money (everyone knows at least one Finance Bro!) If you really want to improve your life and set yourself up for the future, it pays to read financial books written by women too – they often have a deeper appreciation of challenges like the gender pay gap, societal expectations, and retirement inequality, that affect how we make and manage money. To save you digging through recommendation lists filled with Daves, Johns and Scotts, here are five eye-opening financial books written by women.

There’s variety here too – whether you’re reading this with $10 left in your bank account or you’re researching wealth growth strategies, we’re sure there’s something here for you!

Money School by Lacey Filipich

Flipich’s Money School will explain how to build your own simple yet solid financial plan – the basics you need to understand to stay on top of your personal finances for life. Her own experience with burnout and personal tragedy has made her an advocate of the FITR strategy: Financial Independence, Time Rich as a much more appealing and practical alternative to the controversial FIRE strategy (Financial Independence, Retire Early).

Think of Lacey and her Money School as an alternative to Scott Pape and his Barefoot Investor – both are Australian authors, and if his book didn’t resonate with you, then Filipich might just be the trick. Get a copy here.

Clever Girl Finance: Learn How Investing Works, Grow Your Money by Bola Sokunbi

Did you know that most financial advice for women (patronisingly) focuses on saving and budgeting, while most financial advice for men focuses on investing and growing wealth? Fuck that. Growing wealth by investing is something that all women should learn about, and Bola Sokunbi’s book is an informative, accessible and empowering place to start.

It’s part of her Clever Girl Finance three-book series, including one on personal finance basics and another on growing a side hustle – all from the perspective of a leader who knows the struggles of being a Black, immigrant woman trying to find success. While she wrote the series specifically to serve women of colour, there are lessons here for everybody. Get a copy here.

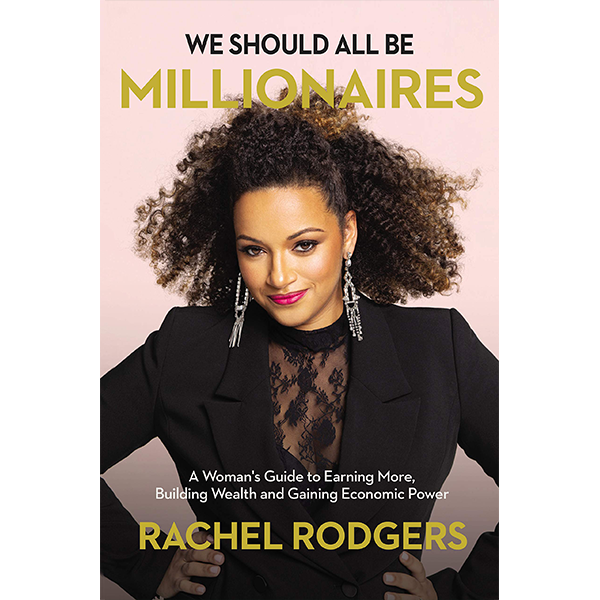

We Should All Be Millionaires by Rachel Rodgers

Let’s soak up this book’s glorious tagline for a moment: A Woman’s Guide to Earning More, Building Wealth, and Gaining Economic Power. Yes, yes, and yes.

Rodgers is a self-made millionaire who shares her no bullshit advice for growing the kind of lasting wealth that could help us change the world (for the better). You’ll learn about the structures that have locked women and people of colour from building wealth, how to avoid “broke ass decision making”, and how to get past the six-figure income barrier. Spoiler alert: You can’t really do it with a salary alone. Get a copy here.

What To Do With Your Money When Crisis Hits: A Survival Guide by Michelle Singletary

Released in May 2021, Michelle Singletary’s guide to surviving the tough times is a lifeline to anyone caught in the economic fallout of COVID (most of us, tbh). What To Do With Your Money is practical, focusing on helping you make the important, urgent decisions that arise when money is tight and opportunity is scarce.

The advice applies for any rough patch – whether that’s a nation-wide recession that affects everyone, or a personal debt crisis in your own household – making it a timely and timeless addition to your bookshelf. Read, then pass around to friends and family who might need a hand. Get a copy here.

The Art of Money by Bari Tessler

Less of a practical how-to guide, The Art of Money is more about understanding the underlying beliefs and emotional relationship we all have with money. Our psychology dictates our decision making, so ‘financial therapist’ Bari Tessler uses the book to unpack subconscious beliefs about money that help or hinder your ability to be financially confident.

This is one of the most recommended ‘money mindset’ books out there, and worth reading once you’ve got your personal finance basics on lock. Get a copy here