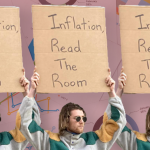

Last night Treasurer Jim Chalmers delivered the 2022-23 Federal Budget, the first of this new Labor government. The plan comes at a time of record high inflation and other factors putting the country in the midst of a cost-of-living crisis. It’s also an interim plan which will carry us through to the first full budget in May 2023.

Our broad stance on the budget is: Brace yourselves. The economic climate is tough right now, and this budget shows it’s going to get tougher in at least the next year. Not all of the factors are within the government’s control, but some of them are. We’re optimistic that the full FY23/24 budget next year will go further.

But for now… we’re going to hone in on the areas that you told us are most important.

| Wages & Inflation | Tax |

| Jobs & Education | Energy & Fossil Fuels |

| Climate Action | Housing |

| Health & Wellbeing | Welfare |

WAGES & INFLATION:

What’s been promised: Not much, which is scary. The 22/23 included a few agreements that had already been announced:

- Supporting a wage increase for aged care workers;

- the Fair Work Commission’s decision to increase minimum wage by $40 a week; and

- 3% pay increase for the public service for the next 12 months (an interim measure only).

Increasing public sector pay is one way the government can help lift wages for the rest of us, but the 3% raise is less than inflation… meaning their pay doesn’t actually go up in real terms.

What does this mean? Even though Chalmers said the government wants to “getting wages moving again”, the budget doesn’t really show how they plan to do it. In fact, it’s clear that wages will not grow in any helpful or meaningful way until 2024 at the absolute earliest. Even worse, the budget papers predict higher unemployment in the next 12 months and an inflation peak of 7.75% by the end of year.

With the exception of childcare subsidies and some changes to age and veteran pensions, there are not a lot of measures in this budget that provide direct help for managing the tougher times to come. Unless you’re one of the wealthy few, expect the next few years to be very tight.

TAX:

What’s been promised? The ATO will receive $200 million a year for the next four years for the Tax Avoidance Taskforce which does exactly what the name suggests. This additional money will help them focus on multinationals and large businesses, rather than the average person. This is expected to return an additional $2.8 billion to the government. Good.

The topic everyone’s been talking about are those Stage 3 tax cuts (explained here by the ABC), that will come into effect on 1 July 2024. This was a plan devised by the Coalition and at the election Labor said they would stick to it – and they have. For now.

What does this mean? Australia’s economy relies heavily on income tax, which is widening the gap between low and middle income earners, and between middle income earners and the wealthy. Abandoning the Stage 3 tax cuts is a good place to start taking the pressure off those with lower incomes (less than $95,000), especially when inflation is so high, but what’s really needed is full tax reform.

Labor has not done anything to change that in this budget, but there are small signs they’re considering more ambitious action in the next one. Maybe.

JOBS & EDUCATION:

What’s been promised? Outcomes from the 2022 Jobs Summit are already being funded. There is $870 million (over five years) to cover 480,000 fee-free TAFE spots – with 180,000 students to have their fees covered in 2023. These positions will be granted in industries and regions with skill shortages.

For universities, $480 million over four years will add 20,000 Commonwealth-supported university places – most of these will be in teaching and nursing degrees, and are intended for students from underrepresented or disadvantaged backgrounds.

When it comes to schools, of the $26.7 billion allocated in 22/23 more than 60% of this goes to private schools. So while Chalmers’ speech highlighted programs like the Schools Upgrade Fund, more government money is still going to private schools – another source of serious inequality in Australia.

What does this mean? We’ve combined Jobs & Education here deliberately, as this budget continues a concerning trend of federal governments valuing higher education as a pathway to a job as opposed to institutions for education, ideas and learning. The arts sector has been basically ignored in this budget, which makes sense when the majority of funding is poured into ‘practical’ education and courses. Remember the Morrison government’s decision to

ENERGY & FOSSIL FUELS:

What’s been promised? This is the most requested topic by Zee Feed readers. So we’ll just say it straight: the big sources of funding for mining companies are all still there. The Fuel Tax Credits Scheme (which subsidises the cost of fuel for mining operations) gets $7 billion this year, and will increase each year up to $11.2b in 2024.

Some of the Coalition’s ill-advised gas and carbon capture storage projects were removed from the budget (saving over $300m), but the $1.9 billion Middle Arm petrochemical and gas carbon capture storage project was included. It’s a very controversial project.

The good news is that funding for renewables is increasing. The government has dedicated $20billion to the Rewiring the Nation program – a key election promise that will upgrade Australia’s electricity transmission network to better accommodate renewable energy. They have also committed a bunch of money under the Powering Australia program to fund things like:

- Community solar and clean energy programs ($102m over four years)

- Developing microgrids to support reliable clean energy to remote Aboriginal communities ($83m)

What does this mean? These are very small baby steps in transitioning both Australia’s energy consumption and economy away from fossil fuels. They are too small and too slow, but we shouldn’t be surprised. Labor made it very clear during the election that they will continue to support the fossil fuels industry well into the future – this budget shows us they really meant that.

CLIMATE ACTION:

What’s been promised? There are a lot of smaller funding amounts for specific climate action projects in this budget – the Australian Conservation Foundation has a summary. There are some two key, big ticket items:

- Climate Change Authority gets $290m to get back up and running, as a key part of Labor’s new climate change bill

- $226m over four years on water infrastructure projects, to protect against the worsening water crisis

- $200m per year for disaster prevention and resilience projects, the majority of which is now climate-related, as part of the Disaster Ready Fund

- $161.8m over the next four years to reduce transport emissions, under the Driving the Nation Fund

The Conversation calculates climate-related spending totals $25b by 2029.

What does this mean? Labor has updated the structure of the actual budget papers to include a new section, called “Measuring What Matters.” It compares how Australia is doing on the important topics that can’t always be measured in dollars – and that includes the impact of the climate crisis. If you have the time, this chapter of the budget is worth reading in full (it’s not very long).

This chapter includes a clear, direct acknowledgment that the government doesn’t know whether we’re on track to meet the legislated emissions reductions commitments. While that isn’t good news, the fact that the government is a) admitting to this, and b) will now be tracking climate metrics annually is a big turn around from the attitude of the previous government. There’s hope!

HOUSING:

What’s been promised? The big star of the 2022 Budget was the historic National Housing Accord – it’s an agreement between the government and key stakeholders to one million homes by 2030. The Federal government has allocated $350m to building 10,000 affordable homes in the same time period.

This budget also included :

- $324m over four years for the Help to Buy scheme, helping 40,000 low to moderate income Australian purchase a home

- Up to $500m each year in the Housing Australia Future Fund, some of which will be used to build 20,000 social housing properties

What does this mean? The aim of all this housing construction cash is to increase the supply of homes, decreasing competition to lower prices – ultimately making home ownership more affordable for people. That, in theory, absolutely will help to bring property prices down from their current crazy heights. This issue is with the description of the intended houses to be “affordable” (a vague term) and “well-located” (suggesting that they won’t, in fact, be that affordable). It’s a better strategy than the Coalition’s history of giving first home buyers extra cash, which only helped drive up prices. But the result won’t be delivered in one budget alone.

HEALTH, WELLBEING & WELFARE:

What’s been promised in Health: $787.1 million over four years to reduce the co-payment for medicines on the Pharmaceutical Benefits Scheme (PBS). It brings the co-payment down from $42.50 to $30. Another election promise to set up Urgent Care Clinics is being funded with $235m – these clinics will reduce the pressure on hospitals by taking patients who need non-emergency care.

The taskforce that is currently working on recommendations to improve Medicare is due to publish its report by the end of the year, and the budget has allocated $750m to implementing those recommendations.

There is also $126m to set up an NDIS fraud taskforce (similar to the ATO tax avoidance crackdown) that will target “fraud and serious non-compliance”. The budget predicts this will return around $290m to the government over four years.

Mental health has been such a big focus in the previous two budget, so it’s surprising to not see any major funding investments this time around.

What’s been promised in Welfare: The big line item is childcare – $4.7bn over four years in subsidies for childcare, to help get parents (especially women) into the workforce. Aged care receives the next biggest spend is $2.5b to increase the quality of care and staffing, in particular ensuring registered nurses are on-site 24-hours a day. For Pensioners (age and veteran) almost $62m will be spent to remove financial disincentives limiting how much they can work. This will help increase their income, easing the pain of the cost of living rises.

But other welfare support payments – including Jobseeker – are staying more or less the same in this budget. The increase in funding is wiped out thanks to inflation, leaving every welfare payment under the Henderson poverty line of $616 a week.

What does this mean? To truly be considered a “wellbeing” budget, like Chalmers claimed it would be, we needed to real support for Australia’s most vulnerable. There is no excuse for a country as wealthy as Australia for knowingly and deliberately keeping people in poverty. This budget ultimately keeps millions of Australians in survival mode, with limited relief as the cost of housing, basic health care and education all continue to increase. It doesn’t make us feel well, tbh.

Adding the new “Measuring What Matters” section is a good sign and a glimmer of hope. It puts the Labor government is in a much better position to track how budget decisions actually affect – and hopefully improve – our lives. We’ll be keen to see how honestly and rigorously this section is used in the next few budgets. It has the potential to be one of the most important, helpful changes to how the federal government communicates with the public we’ve seen in a long time.

Comments are closed.