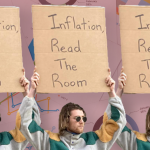

“Spend less! Create a budget! It’s time to invest! No more Netflix!” This is the kind of not-particularly-helpful advice we constantly see from the usual ‘experts’ when an economic downturn is looming. The thing is, often the people who traditional media turn to for money management tips haven’t had to live on the brink. Earlier this year, a money columnist advised ‘cutting back’ by dropping a $386 per month gym membership, while an ‘expert’ on Sunrise recommended selling your second car and investing in a… mop? Ok then.

We’re frankly tired of listening to unrelatable financial tips from people who don’t understand the struggle. So we got some advice from people who’ve lived it themselves, or directly helped others who have. Here’s more realistic tips for young people who don’t have a second car to flog.

General Tips For Cutting Costs & Increasing Income

Economists are warning us that there will be very tough times to come in the next 12 months. Solving that is the government’s job, and until they sort it out all we can do is ensure we survive. That’s where the underlying message from financial experts is unfortunately accurate – you’ll need to have a detailed understanding of your position, and find ways to increase income and decrease costs. A few ways you can make more room in your budget are:

- Have a conversation with your social circle

We should all be talking about money with each other more often, and more openly. Have the conversation with friends and family about the cost of living and needing to cut back on spending – especially at this time of year. Chances are they’re feeling stretched too, and you can all agree to switch shared activities to cheaper options – low budget Secret Santa gifts, catching up at home instead of going out, having friend dates on weeknights for the pub specials. - Ask for a pay rise (or a bonus)

Wages in Australia have barely grown in the past decade. If you’re on an individual employment contract (as opposed to an enterprise agreement) you should ask for a pay rise or an increase to your hourly rate. If a pay rise is off the table, can you negotiate a bonus for hitting a performance target? If your employer says no, ask what their timeline or process for reviewing pay will be. If you’re a contractor, freelancer or sole trader, increase your prices for 2023 and flag the coming change to existing clients now. - Shop around for better deals on…

All your regular bills – if a utility company is not rewarding your loyalty, it’s time to move! Find the best new customer deals on your electricity, Internet and phone bills. Alternatively, call your currently service provider to ask for the best deal and see what they can do. No harm in asking! - Join local Buy Nothing & trade groups

There are Buy Nothing groups right across the country, dedicated to sharing and giving away just about anything you could imagine . While some groups are more active than others, it’s still worth checking out the ones closest to you – there is a full list here. Having a community for support during tough times is so important, which is something Buy Nothing and other local sharing/trade groups understand pretty well.

Advice if you’re experiencing poverty

Kristin O’Connell founded the Anti-Poverty Centre, an organisation working to defend the rights of people living in poverty in Australia. Kristin knows first hand what it’s like to live below the poverty line: “You cannot budget your way out of poverty. And you must not blame yourself for the situation that you’re in.” Kristin’s advice for weathering the coming storm:

- Question everything when it comes to Centrelink: “When you’re interacting with Centrelink, and the welfare system, you question everything. Don’t trust what they tell you if it doesn’t seem right, because they provide a lot of wrong information that causes a lot of people to lose money. The last thing you need when you’re in poverty is to lose a few dollars, or even worse have to pay them back, when you didn’t have to.”

- Seek out organisations to help you through Centrelink’s grey areas: Kristin recommends three organisations that can help you navigate the often confusing world of Centrelink. “Economic Justice Australia represents community legal centres who specialise in welfare rights. If you’re not sure about what Centrelink has told you, whether it’s about how to report your income, or whether you’re even eligible for a payment, go to them.”

To check whether you really have to do the activities ‘required’ for a Centrelink payment, check in with the Australian Unemployed Workers Union. “A lot of people have caring responsibilities, or already have a job and just need some extra income support, or people are studying… They don’t really have time to do all these stupid activities. If you feel like, ‘I’ve got so much going on, I can’t do this stuff.’ That is probably an indicator that you don’t need to be jumping through as many hoops. If you want to clarify that you can call up the Australian Unemployed Workers Union.”

And if something goes wrong with your payments or application process, contact the National Customer Service Line. “You can call them up and you can report [unfair] behaviour. You can also request things like a review of how many activities you’re being required to do [for your Centrelink payment]. There are lots of mistakes in the system and it takes effort, but you can get them corrected. So if your payment gets cut off, it may not be because you’ve done something wrong, it may be because there’s a mistake in the system.” - Find a mutual-aid group where you live: “Get involved now. Learn how your mutual aid groups are working, because none of us want to feel like a burden. And if you’re able to get involved in a mutual aid group, it’s a reciprocal arrangement. It’s not charity. It’s people helping each other and that gives us strength, but it also helps us meet those material needs when we don’t have enough.”

- Look up the ACCC and ASIC debt collection guidelines: “If you end up in debt, for any reason, on anything in your life, people should look up [these guidelines]. That is the standard that debt collection companies are supposed to uphold and the debt collection guideline provides a bunch of examples of situations where they’re not allowed to harass someone. That includes people who rely on income support and people who are unemployed. It’s one of the most infuriating things when the government is aggressively pursuing people over a Centrelink debt when they’re actually breaching their own debt collection guidelines.”

Surviving Recession As A Gig Worker or Freelancer

Fiona Killackey had just moved to London and was working as a freelancer when the Global Financial Crisis hit – a time when finding work was difficult and budgets were incredibly tight. She not only survived the recession, but took the learnings to grow consulting business, My Daily Business Coach, which helps other small businesses, freelancers and small operators navigate similarly tricky circumstances. Gig and contract work makes up a greater portion of Australia’s workforce than ever before – if that’s you, here’s how Fiona recommends you prepare:

- Know your survival rate: “That is what you need to literally survive from rent, basic supermarket weekly shop, petrol etc. I remember doing this before the GFC hit and figuring out the absolute base I needed to live. Once you know that, then figure out what you can cull or cut back on now. Ensuring you meet that baseline survival rate may mean taking on a client or project that’s not ideal, but allows you to cover your costs so that extra stress isn’t there when you’re still trying to be creative.

One of my editors once told me to bank enough cash for three months. That way, if everything takes a turn for the worst you have three months to find a job and are not taking the first thing that comes along.” - Rank your outgoings: “We all have stuff, like online subscriptions, that we are paying for and don’t actually use. Look at your outgoings and rate them out of 10; 10 being you can’t live without it. Anything below a five or six, consider cutting back on. You may be totally fine and not actually see a pay cut, but it’s better to bank up some cash now in preparation, rather than later when it may be more difficult to do.”

- Keep pitching: “Rather than thinking to yourself, ‘oh I’m sure XYZ won’t be hiring freelancers now with the recession coming’, pitch as if everything is fine. [A recession] may actually work in your favour so you want to be there, ready for work that may come your way. Throughout the GFC I actually gained more work, somewhat surprisingly, because more companies had a smaller budget that could accommodate a freelancer rather than a full time employee, so could hire me on a short-term basis.”

- Learn to switch-off from the stress: “I remember applying for 300+ jobs when the GFC was happening. It was full on and scary, and my husband and I spent hours and hours each day online looking for work. I got through a lot of uncertainty by teaching myself to quilt during the GFC through YouTube content. It gave me something to do, it was cheap and I felt like I’d achieved something at the end. My husband did a lot of painting and we look back at that time as one of the most creative and rewarding. You may have to take a different job or project for a while to make ends meet but don’t let it stop you from being creative and indulging in your creative passions.

Recessions don’t last forever, so while you may need to cut back, it’s important not to cut yourself off entirely from having fun. We still had fun in the evenings and weekends and even during the day we would take a break at lunch, go down and get 20p beigels and enjoy the free sights of London. We figured out how to do things for less money.”

Financial Mindset Advice

And lastly, whether we hit a technical recession or not, there is always room to improve the way we think and feel about money. Not in the gross ‘manifesting wealth by simply believing’ sense, but working on the psychological hardships that comes with financial stress. Jane Monica-Jones is a therapist who specialises in the behavioural aspect of money – she suggest we mentally prepare by:

- Remember the current landscape is temporary: “It is important to view recessions or any periods of adversity as temporary setbacks or resets.” The economic landscape will improve at some point, and it can be comforting to know that the external factors that you can’t control won’t last forever. Things will ease, you just have to hang in there until they do.

- Understand your triggers: “Consider what makes you lose your sense of grounding or level headedness, such as too much stress or overextending oneself.” We all have financial triggers, and while it’s not always possible to eliminate these completely, being aware of can help you minimise their impact. Jane says triggers often lead to “unsupportive habits like overspending or accumulating bad debt” – working on improving unsupportive reactions to financial triggers is an important skill to master for life.

- Practise asking for help: “Whether it is our general mental health or financial wellbeing, not all of us received the complete tool box to deal with adversity and challenges.” And there is absolutely no shame in that. Get comfortable with asking for help – most people in your community actually want to! They just need to know what you need.

Comments are closed.